Transform your Users’ Banking Experience with Transaction Enrichment

Enrich raw data with our location-enhanced API to provide an intuitive experience that drives higher user engagement.

Rapid implementation

through a single API

Developer-centric API deployable within days, consistently refined for optimal performance.

Enterprise-ready

and highly scalable

Crafted for effortless scalability and seamless integration, ensuring high deployability.

Accessible across a

variety of technologies

Our API enriches transactions from any payment scheme and open banking sources.

Secure and

reliable platform

Snowdrop’s MRS API is GDPR-compliant and it does not require any personal data.

Benefits of Transaction Enrichment

| Enhanced User Experience Increased customer satisfaction, trust, and brand positioning. | |

| Lower Operating Costs Proven decrease in customer service queries by up to 30%. | |

| Reduced Customer Churn Improved customer lifetime value and minimised customer attrition. |

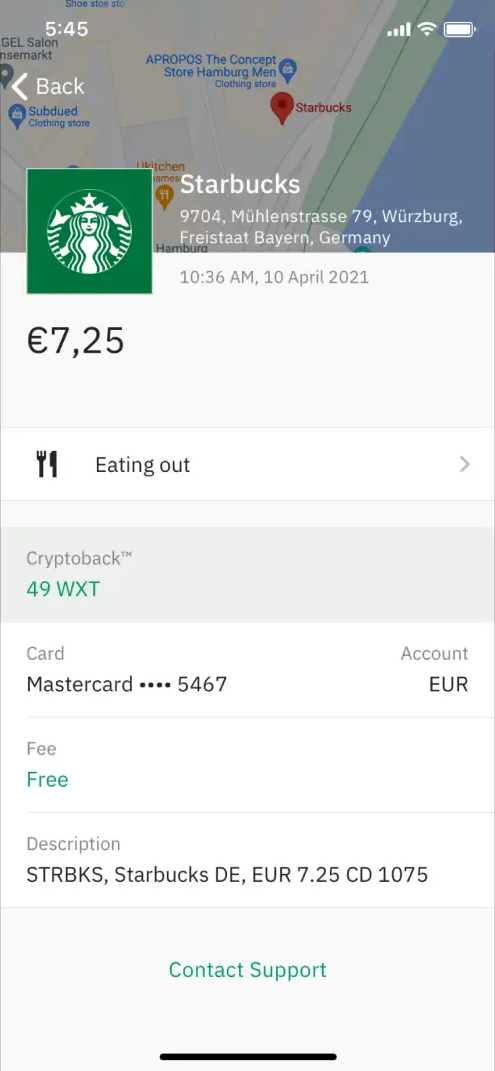

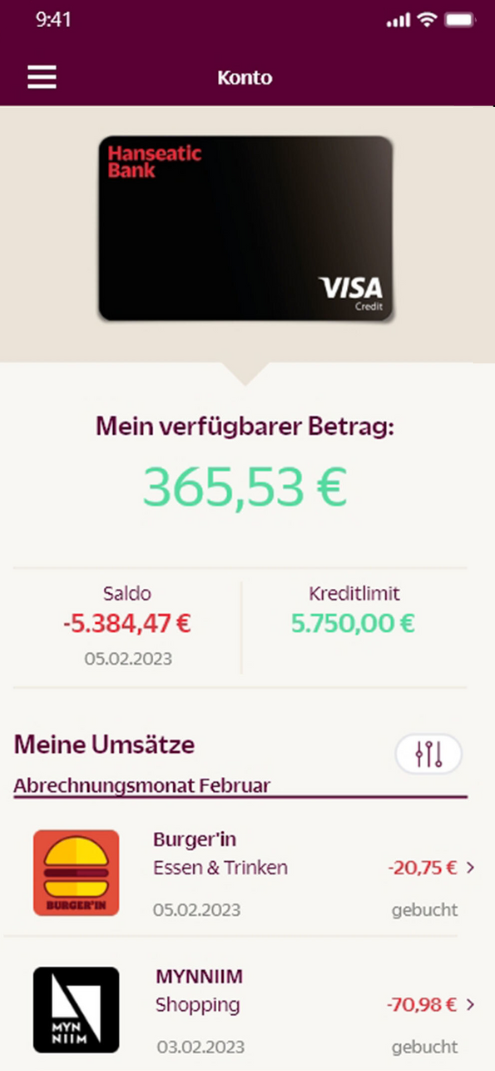

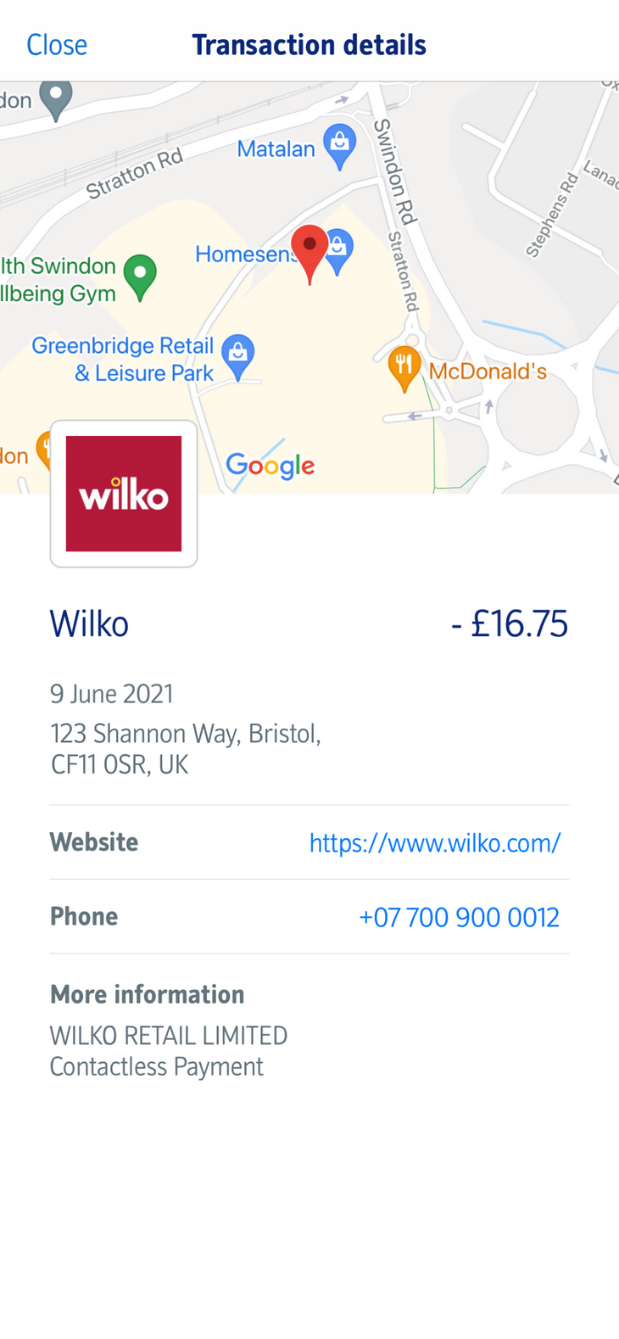

API Features for the Most Accurate Data

| Merchant clean name Display the clean name of merchant for easy identification. | Categorisation Accurately order purchases for better control/tracking of spending habits. |

| Merchant logo Easily add logos to every transaction for quick visual recognition. | Contact details Allows your customer to contact the merchant directly. |

| Verified Location Provide your users with the verified address of their purchase to avoid potential fraud. | ESG Tagging Provide insights into the sustainability performance of the merchants. |

Blend Seamlessly with our Enriched Data API

Enhance data accuracy by integrating meaningful details into each transaction, enriching the overall dataset with valuable insights.

Ensure instant transaction recognition, swift identification of fraudulent transactions, and real-time engagement within your operational processes.

News

-

Snowdrop & PwC Middle East Team Up to Empower Banks with Transaction Enrichment

In a move to empower banks across the Middle East, Snowdrop and PwC Middle East announce a strategic partnership to…