September 22, 2020

SCB collaborates with Snowdrop to enhance digital banking using Google Maps Platform

Customers can now benefit from intuitive, real-time information about their spending habits, and verify where transactions were made

Singapore, 22nd September 2020

Standard Chartered Bank (the Bank) has launched Standard Chartered Places (SC Locate), a new banking enhancement that maps out where users spend their money.

Built in partnership with market leaders Google Maps Platform and Snowdrop Solutions, SC Locate will enable the Bank’s retail clients to visualise their expenses in an interactive and intuitive way on its digital banking platforms.

A first in Singapore, this new enhancement will:

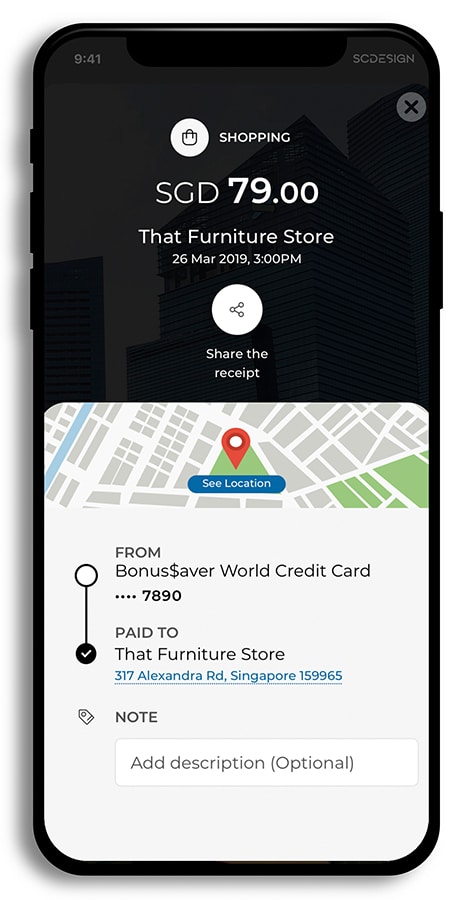

- Turn confusing transaction information into clean, easily identifiable places shown on a Google map with real-time notifications,

- Include related logos and categories for major brands, including both on-line and in-store merchants, and

- Enable customers to see their spending habits and recognise transactions even when traveling abroad.

Powered by Snowdrop’s Merchant Reconciliation System (“MRS”), the technology scans the payment processing messages typically found in a bank statement, cleans up the data, finds a matching logo, and locates the relevant merchant using Google Maps Platform. This eliminates consumer angst around unclear transactions.

By making transactions more transparent, we help make banking more transparent. We are thrilled to be working

alongside Standard Chartered Bank and the opportunity to create intuitive banking services in Singapore and the surrounding region with a single-minded focus on the customer experience.”

This capability falls within Standard Chartered Money Manager (SC Money Manager), the Bank’s personal financial management tool, which is available on its digital banking platforms. With SC Money Manager, clients can also customise and set monthly budgets, track their spending across multiple spending categories, and make use of insights to make their money go the extra mile.

The traditional way card transaction details are presented may appear to be vague and at times confusing; we have experienced customers viewing their statements and calling to get more details on where the transactions are made. With technology and innovation, we are elevating the whole experience through SC Locate and giving our customers a visual context where and when they have spent their money. Yet another first for Standard Chartered in Singapore. This partnership reflects the Bank’s focus on creating delightful experiences that place the consumer at the heart of our digital transformation.”

Highlights from Dwaipayan Sadhu

https://embed-ssl.wistia.com/deliveries/f414e8826aa69447060e306c53f11bd0.bin

Introducing SC Locate by Standard Chartered

https://embed-ssl.wistia.com/deliveries/a822821b4fa1317eae3b1ec2911b1000.bin

If you would like to find out more, visit sc.com/sg/scmm

About Standard Chartered

Standard Chartered Bank in Singapore is part of an international banking group, with more than 150 years of history in some of the world’s most dynamic markets. Our purpose is to drive commerce and prosperity through our unique diversity, and our heritage and values are expressed in our brand promise, Here for good.

The Bank has a history of over 160 years in Singapore, where we opened our first branch in 1859. In October 1999, we were among the first international banks to receive a Qualifying Full Bank (QFB) licence, an endorsement of the Group’s longstanding commitment to our business in the country.

Singapore is home to the majority of our global business leadership, our technology operations, as well as SC Ventures, our innovation hub. In 2013, the Bank transferred our Singapore Retail and SME businesses to a locally incorporated subsidiary, Standard Chartered Bank (Singapore) Limited (“SCBSL”). And in May 2019, we fully consolidated our business operations in Singapore through the transfer of our Commercial Banking, Corporate & Institutional Banking and Private Banking businesses to SCBSL. SCBSL is one of the highest-rated banks globally: A1/Stable by Moody’s Investor Services, A/Stable by Standard & Poor’s and A+/Stable by Fitch Ratings. In August 2020, we were the first and only bank to be awarded by the Monetary Authority of Singapore the status of “Significantly Rooted Foreign Bank”.

In Singapore, we support both individual and corporate needs to build wealth and drive commerce at every step of their journey. We do this by offering an entire range of financial services across personal, priority and private banking as well as our business, commercial and corporate banking teams. The Bank has a network of 16 branches, 5 Priority Banking centres, 1 International Banking and Priority Private Centre and 27 ATMs.

For more information please visit www.sc.com/sg.